Payments to foreign affiliates. Compute the value of household furnishing and appliance for income tax purpose accruing to Farid.

It would be more tax efficient if the undertaking rather than the shares of the target company is acquired by a local acquiring company.

. PR 201711 Residence status of individuals. INLAND REVENUE BOARD OF MALAYSIA INCOME TAX TREATMENT OF GOODS AND SERVICES TAX PART I EXPENSES Public Ruling No. The tax treatment of living accommodation provided for an employee by his employer.

1 The ruling addresses taxation of payments made by employers with respect to new employees and clarifies taxation of employer-provided mobile devices and. GLOBAL GUIDE TO MA TAX. 5 Tax implications 3 51 Tax implications of MFRS 117 3 511 Lessor 3 512 Lessee 4 52 Tax implications following the implementation of MFRS 16 521 Lessor 5 522 Lessee 5 523 Short-term leases and leases of low-value assets 6 524 Documentation and.

Vacation time paid for by your employer in two categories. In the absence of a tax treaty the credit available is restricted to half of the foreign tax paid. PR 72017 explains the tax treatment arising from the disposal of plant and machinery which are not subject to control transfer provisions.

A Malaysian company can claim a deduction for royalties management service fees and interest charges paid to foreign affiliates provided that these are made at arms length and the relevant WHTs where applicable have been deducted and remitted to the Malaysian tax authorities. 8 June 2017 Page 1 of 38 1. This Addendum provides clarification on the change in tax treatment of the following- a.

Receiving tax exempt dividends. Cost of leave passage means cost of fares. 12003 Date of Issue.

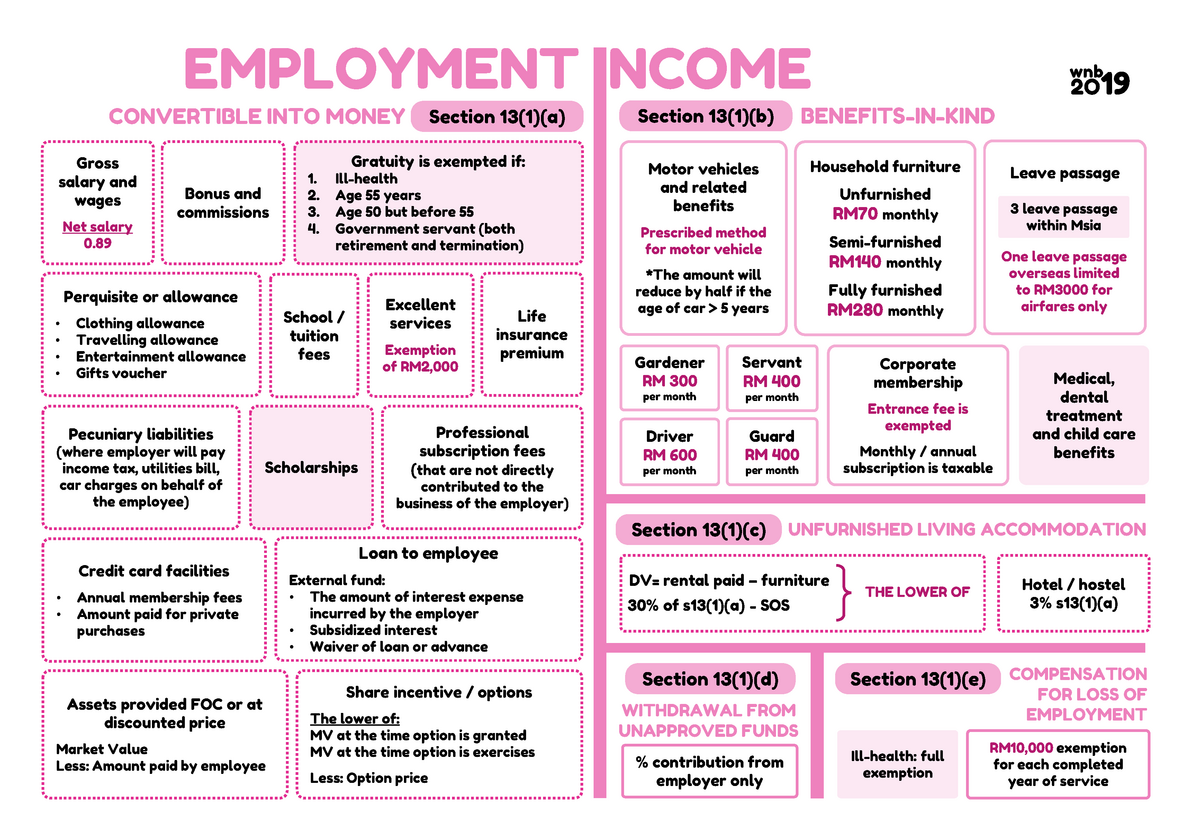

PR 20118 Foreign nationals working in Malaysia tax treatment. 15 March 2013. Here is a list of perquisites and benefits-in-kind that you can exclude from your employment income.

Tax rates in Malaysia. INLAND REVENUE BOARD OF MALAYSIA BENEFITS IN KIND Public Ruling No. These proposals will not become law until their enactment which is expected to be in early 2017 and may be amended in the course of its passage through Parliament.

TAX TREATMENT OF LEAVE PASSAGE ADDENDUM TO PUBLIC RULING NO. Ii Leave passage for travel confined only to the cost of fares for the employee and members of his immediate family. 01012014 - 30062014 RM280 x 6 mths RM1680 01072014 31122014 RM280 x 6 x ½ RM840 Total.

Foreign tax relief. The circumstances in which the value of that benefit can be reduced. Encik Abdullah is exempted from tax on leave passage benefit amounting to RM250000 in the year 2003 for the year of assessment 2003.

She is also exempted from tax for up to three local leave passage benefit amounting to RM150000 in the year 2003 for the year of assessment 2003 but would. 1 Disposal value The disposal value of an asset depending on. Medical and dental benefit.

Medical benefits including traditional medicine and maternity expenses by your employer is tax exempted. The following income categories are exempt from income tax. The driver and leave passage by bearing the tax chargeable on such.

5 August 2003 _____ Mauritius and the total leave passage cost claimed by Encik Abdullah was RM250000. 32013 Date of Issue. 2 Medical and dental.

Where a treaty exists the credit available is the whole of the foreign tax paid or the Malaysian tax levied whichever is lower. The method used to calculate the value of that benefit. Further there is income tax relief of up to 6000 ringgit granted on expenses for medical treatment of serious illnesses.

The home leave passages provided to expatriates their spouses and children are taxable in full. But from 01072017 to 31122014 the house was shared with another employee. Objective The objective of this Public Ruling PR is to explain the tax treatment accorded to a person in respect of goods and services tax GST paid or to be paid as.

The expenses related to such benefit which can be deducted for income tax purposes and the method of calculation. - Local leave passage not exceeding 3 times in a calendar year. The concession is limited to a fixed number of home leave passages per year.

Leave a Reply Cancel reply. Tax Treatment of Home Leave Passage From YA 2018. The notable points covered in this public ruling include the following.

A tax resident is entitled to claim foreign tax credits against Malaysian tax. 13 September 2018 Page 4 of 36 However the following receipts are not included in the component of gross income from employment. Tax Exemption Limit per year Petrol travel toll allowances.

12017 Date of Publication. Budget 2020 has now expanded this to include expenses incurred for fertility treatments. The tax treatment in relation to benefit in kind BIK received by an employee.

PR 20121 Compensation for loss of employment. PR 20111 Taxation of Malaysian employees seconded overseas. Benefit of meals and accommodation provided by an employer to an employee pursuant to local leave passages - subsubparagraph 131biiA Income Tax Act ITA 1967.

Puan Rina is exempted from tax on the overseas leave passage benefit of RM300000 in the year 2003 for the year of assessment 2003 but would be taxed on the remaining amount of RM450000. The exemption is restricted to RM1000. This booklet incorporates in coloured italics the 2017 Malaysian Budget proposals announced on 21 October 2016.

Same group of companies as his employer are not exempted from tax. To subscribe to GMS Flash Alert fill out the subscription form. The following leave passages are exempted from tax.

TAX TREATMENT OF LEAVE PASSAGE INLAND REVENUE BOARD MALAYSIA Public Ruling No. Foreigners with a non-resident status are subjected to a flat taxation rate of 28 this means that the tax percentage will remain the same no matter the amount of income. Employer in relation to an employment means a The master where the relationship of master.

A within Malaysia including meals and accomodation for travel not exceeding 3 times in any calendar year. The Malaysian Inland Revenue Board MIRB has issued Public Ruling 52019 on Perquisites from Employment on 19 November 2019. January 9 2017 at 112 am nice information about the tax system.

INLAND REVENUE BOARD OF MALAYSIA Date of Publication. A maximum of 3 local leave passages including meals A maximum of one overseas leave passage up to a maximum RM3000 for fares only. If the amount exceeds RM6000 further deductions can be made in respect of amount spent for official duties.

Tax Treatment of Home Leave Passage Before YA 2018 Only 20 of the cost of passage is taxable as a concession is granted. As a non-resident youre are also not eligible for any tax deductions. You are entitled to tax exemption not exceeding three times in a year for leave passage within Malaysia and one leave passage outside Malaysia not exceeding RM3000.

If taxable you are required to fill in M Form. In this regard the acquiring company would be entitled to claim a deduction for the interest on borrowings obtained to fund the acquisition of the undertaking.

Emerging Markets Monitor Archive Lazard Asset Management

Emerging Markets Monitor Archive Lazard Asset Management

Wnb Tax267 Employment Income Employment Income Section 13 1 D Wnb 2o 19 Gratuity Is Exempted If Studocu

Jordan Second Review Under The Stand By Arrangement Request For Waivers Of Nonobservance Of Performance Criteria And Modification Of Performance Criteria In Imf Staff Country Reports Volume 2013 Issue 368 2013

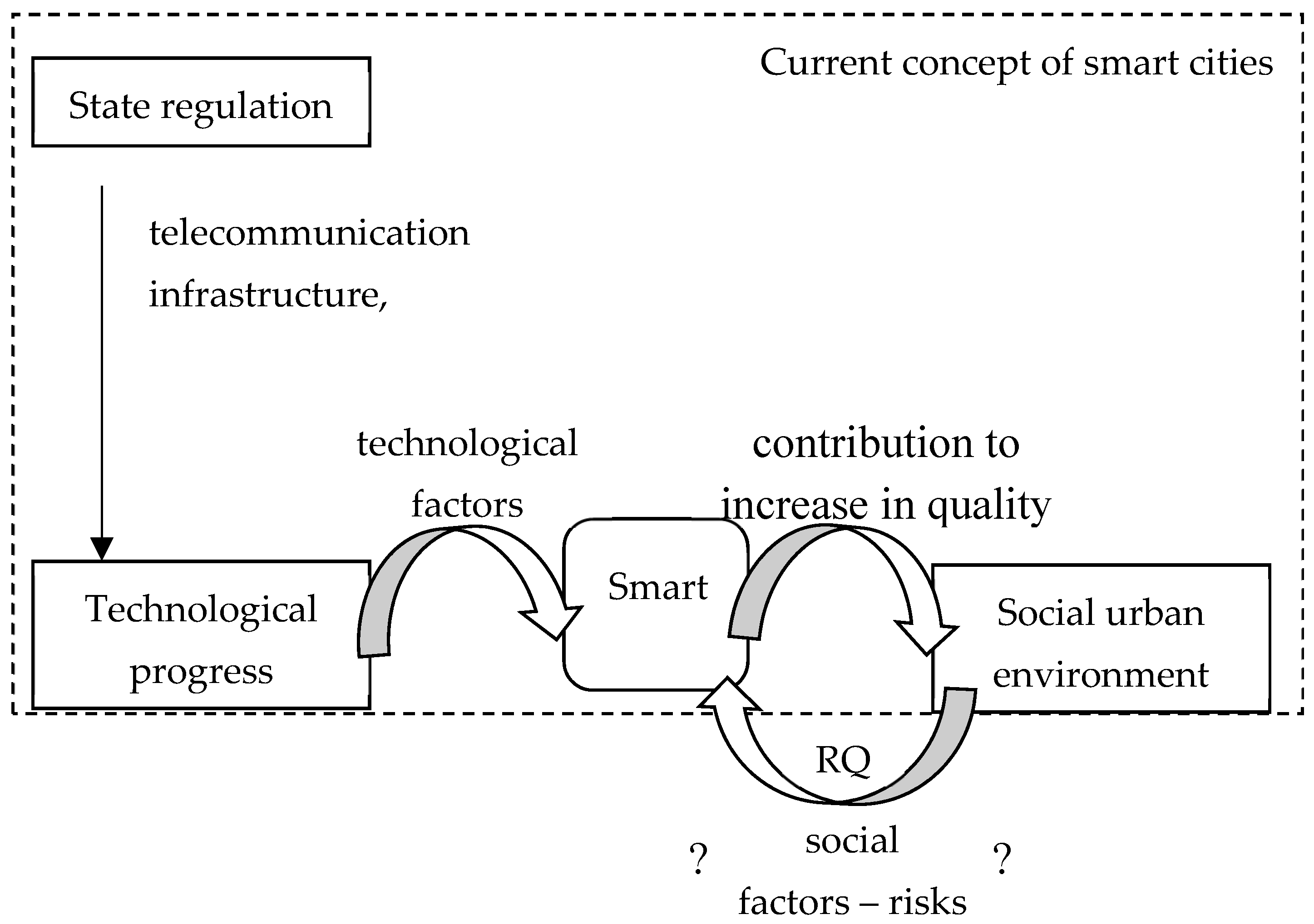

Risks Free Full Text The Risks Of Smart Cities And The Perspectives Of Their Management Based On Corporate Social Responsibility In The Interests Of Sustainable Development Html

Islamic Republic Of Afghanistan Request For A 42 Month Arrangement Under The Extended Credit Facility Press Release Staff Report And Statement By The Executive Director For The Islamic Republic Of Afghanistan In Imf Staff

Emerging Markets Monitor Archive Lazard Asset Management

6 K 1 A19 5541 16k Htm 6 K United States Securities And Exchange Commission Washington D C 20549 Form 6 K Report Of Foreign Issuer Pursuant To Rule 13a 16 Or 15d 16 Of The Securities Exchange Act Of 1934

6 K 1 A19 5541 16k Htm 6 K United States Securities And Exchange Commission Washington D C 20549 Form 6 K Report Of Foreign Issuer Pursuant To Rule 13a 16 Or 15d 16 Of The Securities Exchange Act Of 1934

Emerging Markets Monitor Archive Lazard Asset Management

Avon Products Inc 2019 Annual Report 10 K

6 K 1 A19 5541 16k Htm 6 K United States Securities And Exchange Commission Washington D C 20549 Form 6 K Report Of Foreign Issuer Pursuant To Rule 13a 16 Or 15d 16 Of The Securities Exchange Act Of 1934

Emerging Markets Monitor Archive Lazard Asset Management